Shay inta aan la ogaan taariikdiisa, waxaa muhiim ah ka hor in la ogaado waxa uu yahey

Waa Maxay Lacag?

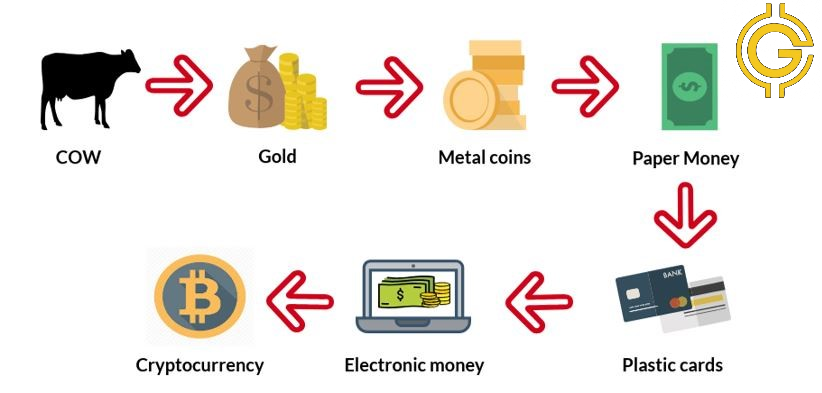

Si fudud, Lacag waa shay helay kalsoonida bulshada, una ogalaanaayo in ay wax isku dhaafsadaan dhexdooda, kana saaraayo meesha ‘barter system’ nidaam is dhaafsi shay isku mid ah ah sida xoolaha, badeecada, dharka suurtagalinaayo in la kaydsan karo waxna lagu kaydsan karo, ka kooban tirooyin la ja-jajibin karo, siina jiri karo muddo daruufaha ku xeeran markaas lagu xalin karo, ayna fududahey in la qaadi karo.

Astaamaha lacagta ay leedahey

Si shay lacag uu u noqdo una helo kalsoonida bulshada waxaa muhiim ah in uu lahaado astaamo ka dhigaayo mid qaali ah, ayna adagtahey in si fudud loo helo.

Waa kuwaan astaamaha lacagta

- Durability: jiritaan iyo adkaysi, astaanta kowaad ee lagu ogaanaayo lacagta waa inay tahey mid jirto muddo aan si dhaqso ah ku dhamaanayn una adkaysan karto in ay wax yeelo soo gaarto, tusaale lacagta birta ah ‘Coins’ waxaa la adeegsan karaa qarniyo way adagtahey inay si dhaqso ah ku baa’bado halka lacagta warqadaha ay jiri karto muddo yar loo baahnayo in la daawaco markasta, lacagta dijitaalka ah ‘Electronic money’ lama kulmayso wax bur bur ah, sababtoo ah maba la taaban karo waa lacag laga arkaayo kaliya shaa’shada, jiritaankeeda waxay ku xerantahey hadba inta uu internetka caalamka ka jiro oo la isticmaalaayo.

- Portability: way fududahey in la qaadi karo lacagta waa astaanta ugu muhiimsan oo laga rabo inay lahaato lacag, waana in safar lagu gali karo lana xawili karo laguna soo xawilo karo, lacagha Paper ‘warqadaha’ iyo Digital money, way sahlantahey in gacanta lagu qaado halka ‘commodity money’ ay adagtahey in la qaado tusaale dahabka, silver-ka.

- Divisibility: shay si uu lacag u noqdo waa in la ja-jabin karo ‘Small unit’ si ay u sahlanaato in la isku dhaafsado waxyaabo kala duwan “different value’ lacagta bitcoin way leedahey ja-jab waxaana loo yaqaanaa ‘satoshi-Sats.

- Uniformity: isku egaansho lacagtu waa inay ahaato mid qiimaheeda isku jaan go’an tusaale $1 dollar waa in ay la qiimo ahaato 1 shilling Somali, balse muhiim ma ahan in ay sarifkooda isku mid noqdaan, hadii lacaguhu ay xambaarsanaan lahaayeen qiimooyin kala duwan tusaale lacag ka bilaawanayso qiimaheeda 100 ama 1,000, waxa ay keen laheed jahwareer sarifkeeda iyo in wax lagu iibsado.

- Acceptability: shay si uu lacag u noqdo waa inuu helo kalsoonida bulshada, muhiim ma aha in shayga lacagta noqonaayo markaas yahey mid qaali ah, balse waxaa muhiim ah inay isku raacdo bulshada markaas adeegsanayso, lacagaha hada wadamada sida USD, EURO, GBP iyo Somali shilling waxaa isku raacay bulshooyinka wadamadaas qiimaheeda iyo inay wax isku dhaafsadaan.

- Store of Value: waa inay noqoto lacagta mid la kaydsan karo, waxna lagu kaydsan karo, qiimaheedana uu jiri karo muddo, hadii shayga lacag laga dhiganaayo uu noqdo mid isticmaalkiisa ay muddo ku xeranyahey lama oran karo lacag sababta oo ah hadii la kaydsado qiimaheeda ayaa lumaayo waadna ku qasaareysaa, balse hadii aysan muddo ku xernayn mar walibo qiimaheeda wuu sii jirayaa, tusaale ‘Gold iyo Bitcoin’ waxaad kaydsan kartaa muddo, waxna waad ku badelan kartaa.

- Stability: ‘Xasilooni jiritaan iyo qiimaheeda, waxaa muhiim ah shayga lacag laga dhiganaayo inuu lahaado awood ka dambeeyo oo maamulo sicirkeeda waxa uu noqon karaa mid centralized ah sida lacagaha wadamada USD iyo JPY ama mid Decentralized sida lacagaha crypto Bitcoin iyo Lite coin.

- Scarcity: waa inay noqoto mid qaali qiimaheedana uu goa’an yahey ‘Limited supply’ inkastoo midaan aysan laheen lacagaha oo dhan gaar ahaan kuwa wadamada sida USD iyo Euro oo hadbo la daawaco inta la doono, taasoo ah caqabada ugu wayn ee bulshooyinka isticmaalo ka cabanayaan waana sababta bitcoin loo door biday qiimaheeda waxa uu ku egyahey 21 million.

Shaqada lacagta ay qabato

Waxaa muhiim ah shayga lacag laga dhiganaayo in uu qabto ‘Specific job’ shaqo gaar ah oo aan suurta gal aheen in lagu qabto shay’da gale ee la adeegsado waana mid aka dhigayso qaali. “Scarcity”.

Waa kuwaan shaqada ay lacagta qabato

- Medium of exchange: in wax lagu kala badasho, waxa aad u isticmaali kartaa in aad wax ku iibsato, kuna iibiso, uma adeegsan kartid waxyaabaha kale aad isticmaasho, sida cunada, dharka, alaabta, xoolaha iwm.

- Unit of Account: in wax lagu cabiro, lacagtu waa halbeega badeecooyinka iyo adeegyada, hadii aysan lacag jiri laheen way adkaan laheed in si fudud loo ganacsado maadaama la adeegsan lahaa nidaamkii hore ee ‘barter system’ in badeeco lagu badalo badeeco kale, balse lacagtu waxay fududeysaa in wax la is dhaafsado.

- Store of value: in la kaydsan karo muddo ama shay lagu kaydsan karo ‘tusaale waxaad lacag ku iibsatey dahab, Bitcoin ama dhul waxaadna ka dhigatey kayd’ “reserve”muddo ka dib kaydkaas waxa uu kuu sameynayaa faa’ido.

- Future payment: in la adeegsan karo mustaqbalka, waa inay noqoto mid wax lagu kala daysan karo, lagu bixin karo heshiisyada mustaqbalka sida, kiraynta guryaha, amaahda, ganacsiyada mustaqbalka.

Farqiga u dhaxeeyo Money iyo Currency.

waxaa jirto labo eray ‘terminology’ ay dadku isku qaldaan badanaa waa money iyo Curency, Af somali ahaan labuduba waxay noqonayaan lacag balse micno ahaan way kala duwan yihiin.

Money ‘Lacag’ Si guud waa shay kasta oo loo isticmaali karo in la kaydsado, waxna lagu kaydsado “store of value’ wax lagu kala badesho “medium of exchange” laguna cabiro qiimaha adeegyada iyo badeecooyinka “Unit of count” waxaana ka mid noqon karo lacagaha wadamada ay leeyihii ‘fiat curency’ lacagaha badeecooyinka ‘commodity money’, lacagaha Digitalka ‘Cryptocurency’.

Currency, Waa nooc ka mid ah lacagta, waxay noqon kartaa mid la maaulo iyo mid aan lahayn cid dhexe oo maamusho, waxaana tusaale u soo qaadan karaa lacagaha wadamada manta la adeegsado sida USD, yuanka china, Euro iyo shilling Somali waxaa ka dambeeyo oo maamulo qiimaheeda bankiyada dhexe ay leeyihiin dowlada iska leh lacagtaas ay adeegsadaan bulshadooda, kuwa aan laheen cid dhexe oo maamusho waxaa tusaale u ah Gold, Silver, iyo Bitcoin.

Ku soo dhawoow kacaankii qarniga 21-aad.

Ku soo dhawoow kacaankii qarniga 21-aad.